The Union Budget 2025-2026 of India, presented by Finance Minister Nirmala Sitharaman on February 1, 2025, introduces significant reforms aimed at stimulating economic growth, providing tax relief to the middle class, and promoting sustainable development.

Key Highlights:

Taxation Reforms:

Income Tax Relief:

The budget proposes a complete tax rebate for individuals with an annual income up to ₹12.75 lakh, effectively exempting them from income tax. This move is expected to increase disposable income and boost consumer spending.

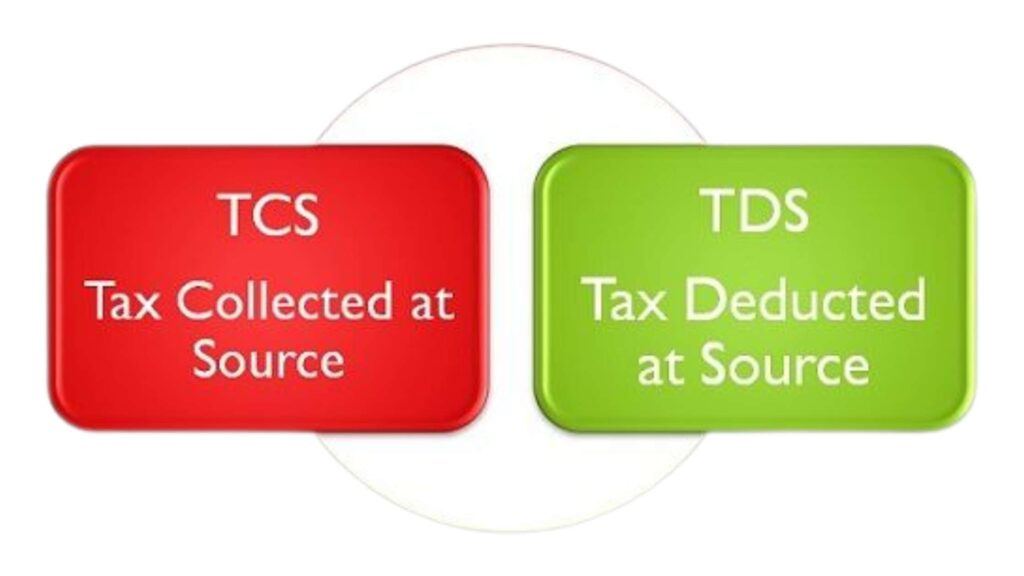

TDS and TCS Adjustments:

The threshold for Tax Deducted at Source (TDS) on interest income for senior citizens has been doubled from ₹50,000 to ₹1 lakh. Additionally, the annual limit for TDS on rent has been increased from ₹2.4 lakh to ₹6 lakh, simplifying compliance for taxpayers.

Agricultural Initiatives:

Prime Minister Dhan-Dhaanya Krishi Yojana:

A new scheme aimed at enhancing agricultural productivity and ensuring food security.

Enhanced Credit Access:

The budget facilitates short-term loans of up to ₹5 lakh for 7.7 crore farmers, fishermen, and dairy farmers through the Kisan Credit Card (KCC) scheme, aiming to support the agrarian economy.

Science and Innovation:

Research and Development Allocation:

An allocation of ₹20,000 crore has been made to implement a private sector-driven research, development, and innovation initiative, fostering technological advancements.

PM Research Fellowship:

The government will provide 10,000 fellowships for technological research in premier institutions like IITs and IISc, encouraging innovation and skill development.

Export Promotion:

Incentives for Electronics and EVs:

Exemptions will be granted for components used in LED/LCD TVs, looms for textiles, and capital goods for lithium-ion batteries used in mobile phones and electric vehicles, promoting manufacturing and exports.

Promotion of Maintenance, Repair, and Overhaul (MRO):

A 10-year exemption will be granted on goods used for shipbuilding and ships meant for breaking, aiming to boost the maritime industry.

Fiscal Management:

Deficit Reduction:

The budget aims to reduce the fiscal deficit to 4.4% of GDP, reflecting the government’s commitment to fiscal prudence.

Additional Measures:

Infrastructure Development:

The government has announced a record capital investment of ₹11.11 trillion to develop infrastructure and technology, particularly in rural areas, to boost economic growth and job creation.

Support for Middle Class:

Significant personal tax cuts have been introduced to stimulate domestic demand amid global economic uncertainties. The tax exemption threshold has been increased, and tax rates for higher incomes have been reduced,. This will help in aiming to boost household consumption, savings, and investment.

Subsidy Allocation:

The budget allocates ₹4.57 trillion for subsidies on food, fertilizers, and rural employment, maintaining a similar level of spending as the previous year to support the rural economy.

Aim of Union Budget 2025-2026:

The Union Budget 2025-2026 introduces several measures aimed at benefiting India’s middle class:

Income Tax Relief:

The budget proposes a complete tax rebate for individuals with an annual income up to ₹12.75 lakh, exempting them from income tax. This initiative is expected to increase disposable income, thereby boosting household savings and consumption.

Standard Deduction Increase:

The standard deduction has been increased from ₹50,000 to ₹75,000, providing additional tax relief to salaried individuals.

TDS and TCS Adjustments:

The threshold for Tax Deducted at Source (TDS) on interest income for senior citizens has been doubled from ₹50,000 to ₹1 lakh. Additionally, the annual limit for TDS on rent has been increased from ₹2.4 lakh to ₹6 lakh, simplifying compliance for taxpayers. These measures are designed to alleviate the financial burden on the middle class, enhance their purchasing power, and stimulate economic growth through increased consumer spending.

Conclusion:

In the Union Budget 2025-2026, Finance Minister Nirmala Sitharaman introduced a complete tax rebate for individuals earning up to ₹12.75 lakh, effectively exempting them from income tax. Additionally, the standard deduction was increased from ₹50,000 to ₹75,000, providing further relief to salaried taxpayers. These measures aim to enhance disposable income and stimulate consumer spending among the middle class.

References

- Union Budget 2025-2026 Documents

- Budget Highlights (Key Features)

- Finance Minister’s Budget Speech 2025-2026

- Financial Times

- Reuters Union Budget 2025

These measures underscore the government’s focus on economic revival, tax simplification, and sustainable development, positioning India for robust growth in the coming years.

Leave a Reply