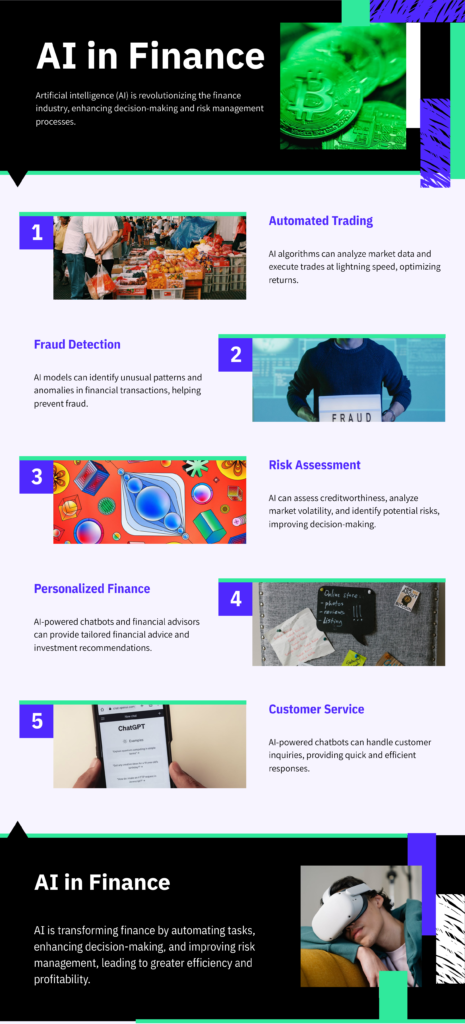

Artificial Intelligence (AI) is revolutionizing the finance industry, transforming how institutions manage risk, make decisions, and optimize operations. From algorithmic trading to fraud detection, AI in finance is driving efficiency, accuracy, and innovation. This 3000-word guide explores the role of AI in the finance sector, its applications in decision-making and risk management, leading AI finance companies, educational opportunities, and future trends.

1. Introduction to AI in Finance

AI in finance refers to the application of machine learning (ML), natural language processing (NLP), and predictive analytics to automate processes, analyze data, and enhance decision-making in financial services.

Key Benefits of AI in Finance

- Improved Accuracy: Reduces human error in data analysis.

- Speed: Processes vast datasets in real time (e.g., stock market trends).

- Cost Efficiency: Automates repetitive tasks like loan underwriting.

- Risk Mitigation: Identifies fraud and predicts market downturns.

2. AI in the Finance Sector: Current Landscape

The AI in finance sector is booming, with the market projected to grow from 10billionin2022to10billionin2022to50 billion by 2028 (Deloitte). Key drivers include:

- Demand for Personalized Services: AI-driven robo-advisors like Betterment tailor investment strategies.

- Regulatory Compliance: AI monitors transactions for anti-money laundering (AML) violations.

- Advanced Analytics: Hedge funds use AI to predict asset prices.

3. AI in Financial Decision-Making

AI in financial decision-making empowers institutions to make data-driven choices. Applications include:

Algorithmic Trading

- Example: JPMorgan’s LOXM uses AI to execute trades at optimal prices.

- Impact: AI processes news sentiment and market data to predict stock movements.

Credit Scoring

- AI Models: Analyze non-traditional data (e.g., social media activity) to assess creditworthiness.

- Case Study: Upstart reduced loan defaults by 75% using ML.

Customer Service

- Chatbots: Bank of America’s Erica handles 50 million client requests annually.

4. Risk Management with AI

AI enhances risk management by identifying threats and predicting outcomes:

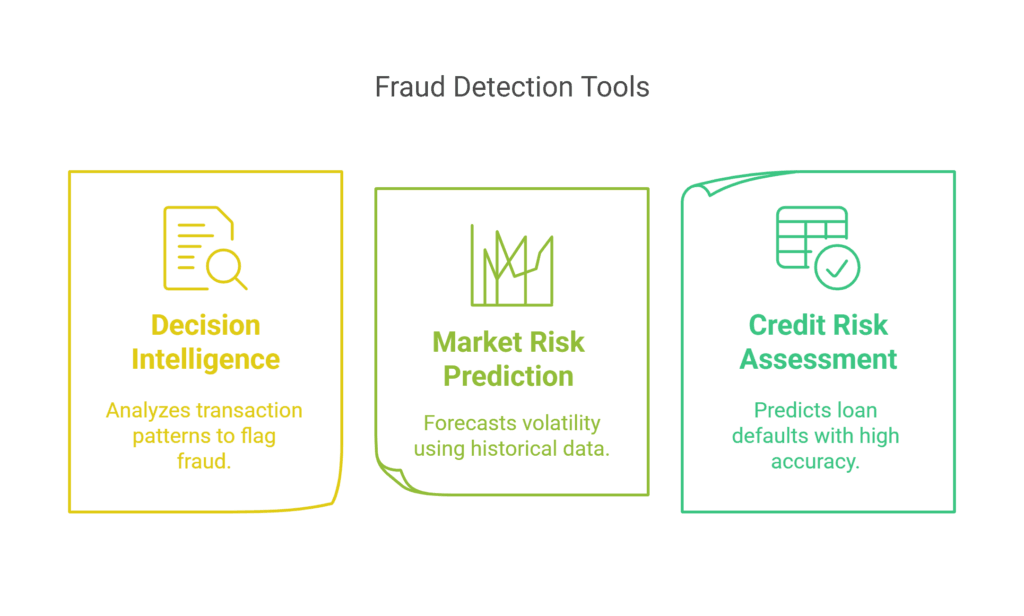

Fraud Detection

- Tools: Mastercard’s Decision Intelligence analyzes transaction patterns to flag fraud.

- Impact: Reduces false positives by 80% (IBM).

Market Risk Prediction

- AI Models: Forecast volatility using historical data and macroeconomic indicators.

Credit Risk Assessment

- Example: Zest AI uses ML to predict loan defaults with 90% accuracy.

5. Artificial Intelligence in Trade Finance

Artificial intelligence in trade finance streamlines global transactions:

- Document Automation: AI extracts data from invoices and letters of credit.

- Fraud Prevention: Detects discrepancies in shipping records.

- Case Study: HSBC reduced processing time by 50% using AI.

6. Leading AI Finance Companies

Top AI finance companies driving innovation include:

- Kensho (S&P Global): Provides AI-driven market analytics.

- Ant Group: Uses AI for credit scoring in microloans.

- Ayasdi: Specializes in AML solutions.

7. AI in Finance Education: Courses and Certifications

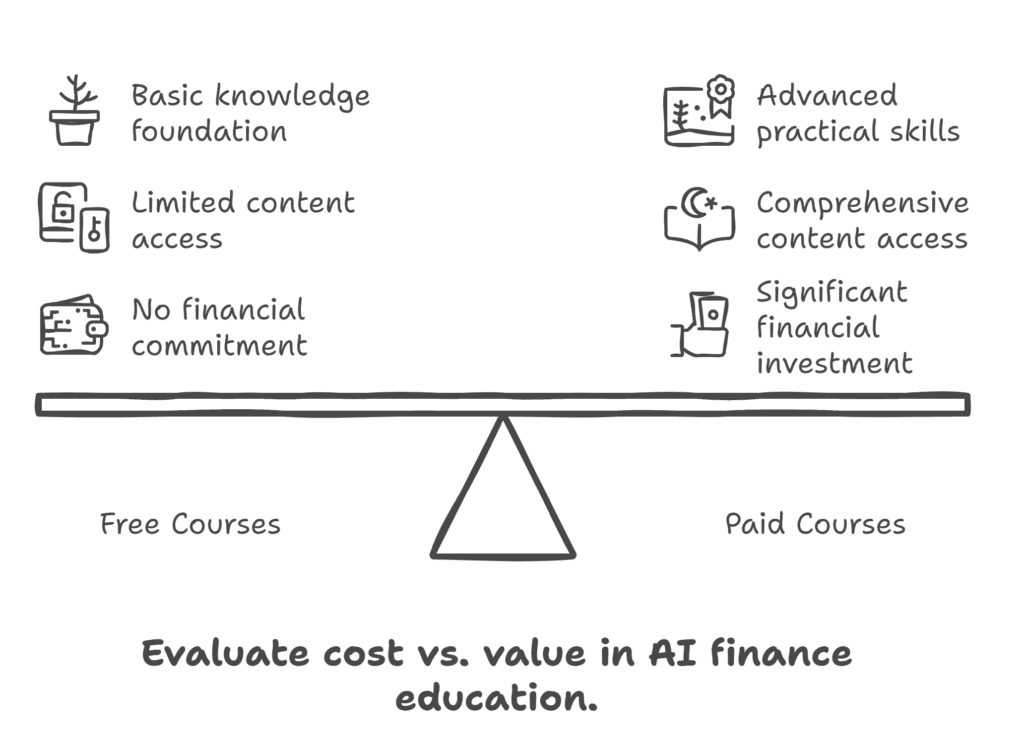

AI in Finance Course Options

- Free Courses:

- Coursera: AI for Trading by Google (Free audit option).

- edX: AI in Finance by NYIF.

- Paid Courses:

- MIT: Machine Learning for Finance ($3,500).

- Udacity: AI for Trading Nanodegree ($1,200/month).

AI Courses for Finance Professionals

- Focus Areas: Algorithmic trading, risk modeling, and NLP for financial reports.

8. AI in Financial Services Forum and Events

AI in Finance Summit 2025

- Focus: Emerging trends like quantum computing and decentralized finance (DeFi).

- Participants: Banks, fintech startups, and regulators.

AI in Financial Services Forum

- Key Topics: Ethical AI, regulatory compliance, and AI-driven customer experiences.

9. Ethical Considerations and Challenges

Key Challenges

- Bias: AI models may replicate biases in training data (e.g., discriminatory loan approvals).

- Transparency: “Black box” algorithms hinder accountability.

- Data Privacy: Securing sensitive financial data from breaches.

Best Practices

- Audit algorithms for fairness.

- Adopt explainable AI (XAI) frameworks.

10. Future Trends in AI and Finance

- Quantum AI: Accelerates complex financial modeling.

- Decentralized Finance (DeFi): AI automates smart contracts.

- Regulatory AI: Governments use AI to monitor systemic risks.

11. AI in Finance Infographic

12. FAQs About AI in Finance

Q1: How does AI improve financial decision-making?

A: AI analyzes real-time data to recommend investments, assess risks, and optimize portfolios.

Q2: What are the fees for AI in finance courses?

A: Free courses are available, while certifications range from 500to500to3,500.

Q3: Which companies lead in AI for trade finance?

A: HSBC, JPMorgan, and CGI are pioneers.

Q4: What is the AI in Finance Summit 2025?

A: A global event discussing AI innovations in banking, trading, and regulation.

Q5: Can AI replace human financial advisors?

A: No—AI augments human expertise by handling data analysis, allowing advisors to focus on client relationships.

13. References

Deloitte Report: AI in Financial Services (2023).

IBM Study: AI in Fraud Detection (2022).

Coursera: AI for Trading.

MIT Sloan: Machine Learning for Finance.

Leave a Reply